The digital transformation of the financial sector continues at an accelerated pace. To remain competitive, financial enterprises must adopt agile and scalable technology solutions. Custom SaaS development presents a powerful pathway for these institutions to tailor software precisely to their unique operational needs.

Let us explore the strategies and benefits of custom SaaS development for financial enterprise software, emphasizing its role in driving innovation and efficiency.

Need a custom SaaS platform tailored for your financial operations?

The Role of Financial Software Development in Modern Enterprises

Financial software development is the foundation for the digital transformation of financial organizations. It includes the creation of specialized systems that meet the unique needs of the finance sector, whether for managing transactions, risk, compliance, or analytics. The market for financial software development is growing exponentially, as businesses seek more sophisticated solutions to improve their operational efficiency.

According to a report by Grand View Research, the global financial software market size was valued at USD 23.98 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 8.6% from 2021 to 2028. This growth is driven by the increasing demand for automation, cloud computing, and data-driven insights. Financial software development plays a pivotal role in ensuring that financial enterprises stay ahead of the competition and meet the growing expectations of consumers and regulators alike.

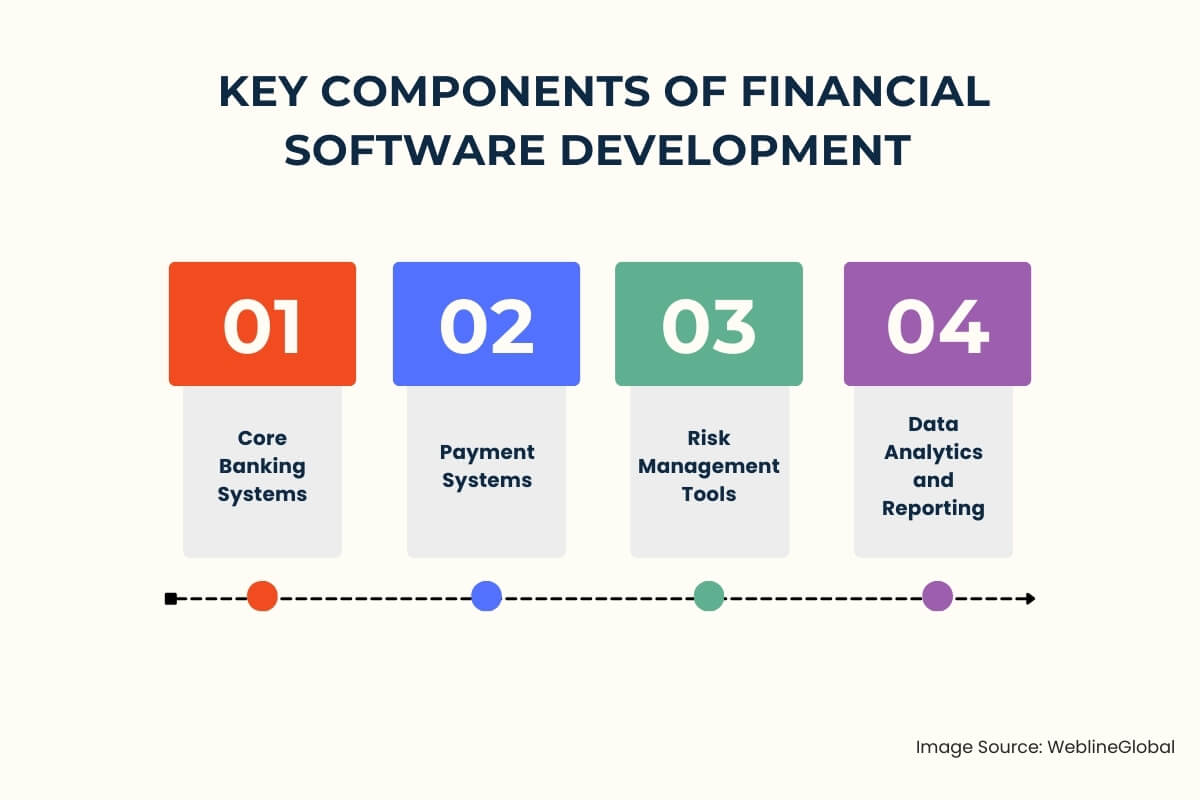

Key Components of Financial Software Development

Developing robust financial software solutions requires an in-depth understanding of the financial industry’s challenges and a strong focus on security, compliance, and scalability.

Some of the key components include:

- Core Banking Systems: These systems facilitate seamless management of financial transactions, account balances, and customer information.

- Payment Systems: These tools ensure secure processing of payments, including credit card processing, wire transfers, and mobile payments.

- Risk Management Tools: Financial software development also involves creating risk management systems that help financial organizations assess and mitigate various risks, from credit risk to operational risk.

- Data Analytics and Reporting: As financial data grows exponentially, software development must integrate advanced analytics to provide real-time insights and predictive models for decision-making.

Why Custom SaaS Development Is Crucial for Financial Enterprises

When it comes to financial software development, one-size-fits-all solutions are rarely sufficient to address the diverse needs of financial organizations. Custom SaaS development offers the flexibility and scalability required to meet these needs. Custom-built SaaS applications allow financial enterprises to tailor their solutions according to specific requirements, giving them a significant advantage in terms of agility, performance, and user experience.

SaaS (Software as a Service) platforms provide cloud-based applications that are accessible through the internet, eliminating the need for heavy upfront investments in infrastructure. Custom SaaS development further enhances this model by delivering solutions that are designed with the unique needs of the client in mind.

Advantages of Custom SaaS Development for Financial Enterprises

Custom SaaS development provides several key benefits to financial enterprises:

Scalability

Financial organizations often face fluctuating demands. Custom SaaS platforms can scale resources up or down as needed, enabling businesses to adapt quickly.

Cost-Efficiency

With SaaS, financial enterprises do not need to maintain expensive hardware or software infrastructure. Custom SaaS solutions help businesses save on capital expenditures while providing access to cutting-edge tools.

Faster Time to Market

Custom SaaS development helps businesses quickly roll out new features or products, ensuring that they stay ahead of competitors and meet market demands.

Data Security

Financial enterprises handle sensitive data, and custom SaaS applications ensure compliance with strict security standards, including encryption and regular security audits.

Enhanced User Experience

Custom software is designed with the end-user in mind, ensuring an intuitive interface and optimal performance across various devices.

Struggling to modernize outdated financial systems?

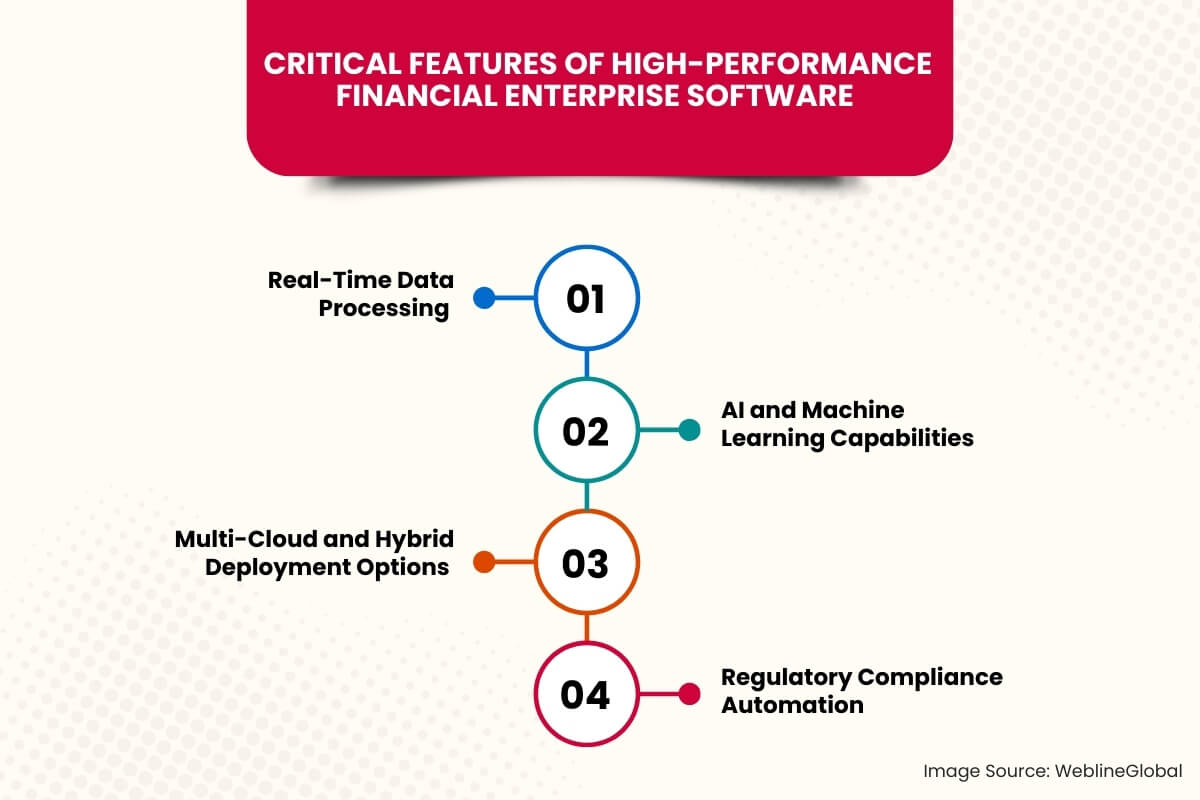

Critical Features of High-Performance Financial Enterprise Software

There are ample features of top-notch financial enterprise software performance. Here are a few popular ones to mention:

1. Real-Time Data Processing

Instant data access is crucial for financial decision-making. Financial software development must support high-speed transactions, live fraud monitoring, and real-time reporting. These features enable faster settlements, reduced risks, and improved responsiveness to market changes.

2. AI and Machine Learning Capabilities

AI enhances financial enterprise software by automating risk assessment, fraud detection, and customer support. Machine learning models analyze transaction patterns, reducing false positives by 60% and improving accuracy in credit scoring and investment predictions.

3. Multi-Cloud and Hybrid Deployment Options

Flexible cloud architectures ensure reliability and scalability. Custom SaaS development should support AWS, Azure, and hybrid cloud models. Kubernetes-driven containerization further optimizes performance, ensuring seamless operations even during peak demand.

4. Regulatory Compliance Automation

Manual compliance processes are error-prone and time-consuming. Automated KYC, audit trails, and dynamic rule engines in financial software development reduce regulatory risks. This ensures adherence to GDPR, PCI-DSS, and other financial regulations with minimal human intervention.

Challenges in Custom SaaS Development for Financial Enterprises

While custom SaaS development offers numerous benefits, financial enterprises face several challenges when adopting or implementing these solutions. These challenges include:

Data Security and Privacy

Financial institutions must adhere to strict regulatory frameworks, such as the GDPR in Europe and the CCPA in California. Ensuring compliance while building custom SaaS applications can be complex.

Integration with Legacy Systems

Many financial organizations rely on outdated systems that are difficult to integrate with modern SaaS applications. Transitioning to cloud-based solutions can be a time-consuming and costly process.

Customization Costs

While custom solutions offer great flexibility, they can also be expensive to develop and maintain. Financial enterprises must balance their need for customization with budget constraints.

Adoption Resistance

Employees accustomed to traditional systems may resist the transition to new SaaS solutions. Overcoming resistance and ensuring smooth adoption requires effective change management strategies.

Ready to modernize your financial operations with secure, scalable SaaS solutions? Let’s build a custom platform that fits your exact needs.

Technical Jargon and Implementation Considerations

Financial software development involves complex technical considerations. Developers must be proficient in various technologies, including:

- Cloud Platforms: AWS, Azure, and Google Cloud Platform for scalable infrastructure.

- Programming Languages: Java, Python, and C++ for robust application development.

- Database Management Systems: SQL and NoSQL databases for efficient data storage and retrieval.

- API Integration: RESTful and SOAP APIs for seamless system integration.

- Security Protocols: OAuth 2.0, SAML, and TLS/SSL for secure data transmission.

- DevOps practices: CI/CD pipelines, containerization (Docker, Kubernetes) for faster deployment and updates.

When implementing custom SaaS development, financial enterprises should consider:

- Choosing a reputable development partner with expertise in the financial sector.

- Establishing clear communication channels and project management processes.

- Conducting thorough testing and quality assurance.

- Providing comprehensive training and support to end-users.

- Planning for long-term maintenance and updates.

Future Trends in Financial Enterprise Software

These trends highlight the importance of custom SaaS development in enabling financial enterprises to adapt to the evolving technological landscape.

The future of financial enterprise software will be shaped by several emerging trends:

- Artificial Intelligence (AI) and Machine Learning (ML): AI-powered solutions will enhance fraud detection, risk management, and customer service.

- Blockchain Technology: Blockchain will streamline transaction processing, enhance security, and enable decentralized finance (DeFi) applications.

- Open Banking and APIs: Open APIs will facilitate data sharing and integration with third-party services, driving innovation.

- Regulatory Technology (RegTech): RegTech solutions will automate compliance processes and reduce regulatory burdens.

- Cloud-Native Architecture: Cloud-native applications will provide greater scalability, flexibility, and resilience.

Why Choose WeblineGlobal for Financial Software Development and Custom SaaS Solutions?

At WeblineGlobal, we understand the challenges that financial enterprises face in developing customized software solutions. With years of experience in financial software development and custom SaaS development, we offer cutting-edge solutions that are tailored to your unique business needs. Our team of experts works closely with you to design, build, and maintain scalable and secure applications that deliver results.

Why Partner with Us?

- Tailored Solutions: We offer custom SaaS development that aligns perfectly with your business goals and industry requirements.

- End-to-End Support: From initial consultation to post-deployment maintenance, we provide comprehensive services for all your financial software development needs.

- Expert Team: Our developers, designers, and engineers have extensive experience in creating cutting-edge solutions for financial enterprises.

- Proven Track Record: We have successfully delivered complex financial software solutions to organizations around the globe, helping them streamline operations and enhance their customer experience.

Whether you need a robust core banking system, a comprehensive payment gateway, or a custom risk management solution, WeblineGlobal has the expertise to create high-performing software that helps your business thrive. We are a top IT agency in the USA focused on security, compliance, and innovation, ensuring that your solutions are not only future-proof but also provide a competitive edge in the fast-paced financial industry.

Social Hashtags

#SaaSDevelopment #CustomSaaS #TechInnovation #CloudSolutions #SoftwareDevelopment #FinancialTechnology #FintechSolutions #DigitalTransformation #EnterpriseSoftware

Looking to streamline compliance and boost performance with secure, regulation-ready SaaS solutions?